Betway

South Africa has always been a sports crazy country with the public heavily supporting all codes of sports. In 2008, for the first time sports betting was legalised in the country.

This has ensured that there are loads of local and international betting sites that have flooded the local online betting market. You may be overloaded with choices as to which are the best betting sites therefore we at Online Betting South Africa have done all the research in finding the legal sites for you.

There are literally a hundred different online betting sites in South Africa and while we cannot review every single one of them, you can rest assured the sites we have reviewed are the best in the country. Here is a short list of sites that we have reviewed:

Check out this page for all the best betting sites in South Africa.

The only form of legalised gambling in South Africa for many decades was horse racing betting but this law changed in 2008 when the first online betting sites were granted permission to trade in the country.

There are of course stringent rules for these betting sites with the most important one being that they must be licensed by one of the provincial gambling boards. The great news for you is that all the bookies we endorse on this site are legal as we have verified their gambling licences.

It is of vital importance that you join a legal betting site as they are mandated to follow a set of rules and regulations. If you bet with an unlicensed site, you are likely to lose your money as they can refuse to pay your winnings and there is nothing you can legally do to retrieve your winnings.

We have you covered in every step of your betting journey from choosing the right bookie through to the registration and eventually to the most pleasant of tasks, withdrawing your winnings.

Find out all you need to know with our comprehensive step by step guide and let us start you off on your betting adventure.

Just be sure to choose a reputable sportsbook and to gamble responsibly!

As we mentioned above in the short instructions – we are going to detail the steps you need to follow in order to get started betting

Choosing the betting site is the most difficult decision for a punter but we have listed a few tips to help you in your search.

These are some of the most important factors to consider before signing up with a new bookie:

Website promotions and offers

There are a number of factors that punters need to take into account when choosing a top online bookmaker. Bonuses, free bets and concessions should be at the forefront of punters’ minds, and they significantly vary by bookmaker.

What sports does the bookie cover?

Betting on football is by far the most popular sport to bet on, and most bookmakers have an expansive betting section for the beautiful game which includes live betting.

However, plenty of punters have a passion and expertise for other sports, and an individual’s preferences for a particular sport can dictate which bookmaker is most suitable for their needs.

Competitive odds and payment options

Most bookmakers are expanding the number of payment methods they offer to clients with the voucher method and Instant EFT options growing exponentially in South Africa. The major betting sites have debit/credit cards, e-wallets, prepaid cards, bank transfers and much more.

Obviously, the competitiveness of odds is vital when choosing a bookmaker. Punters want to find the best possible value in their selections. Therefore, having an account with a bookmaker who works to small margins is important.

Gaining bonuses can provide a powerful boost to punters’ winnings, especially when it comes to offers like a Risk Free first bet.

Online customer service is essential

Any reputable online bookmaker will have a physical address located on its website along with contact information you can use to call them and ask questions if needed.

Trusted bookmakers will even have an FAQ section you can read to help you feel more comfortable about betting with them. Another important source you can use to research online betting sites is social media.

Not all online bookmakers are good at every aspect of sports betting, casino wagering, poker play and horse racing – although you may not need your ideal betting site to be all that.

Instead, your priorities may include making sure the bookmaker pays winners quickly, offers bonus and promotion specials, or articles and tutorials for beginner players.

We have ranked the three best bookies on the local market as follows:

Once you have chosen your favoured bookie and completed the registration process, all that’s left is for you to make the first deposit and start betting.

All new players will need to complete a FICA verification process before they are permitted to make a withdrawal. Here is the step by step process to verify your documents.

In the event it takes longer than 24 hours, you can contact the customer support of the bookie through one of their communication channels.

All of the bookies have a multitude of methods for you to deposit funds into your betting account. You can use the more traditional ways like bank transfers or debit/credit card deposits.

We suggest the Instant EFT options like OZOW and the voucher system as your betting account is immediately credited.

These are the simple steps to follow to deposit funds:

Every punter usually has their favourite sport or sports to bet on as they may have extensive knowledge about the sport. We advise you not to bet on sports that you don’t know about as correctly predicting the results becomes a difficult task.

In South Africa the most popular sport to bet on is football which is closely followed by rugby punters. There is also a huge following for horse racing and more recently the Live casino and betgames have become increasingly popular with players as there is potential to win big.

Read also: Best Casinos

These days the bookies have simplified the entire betting process from registration to placing your first bet. Even if you are new to gambling, placing your first bet is simple and we have also created a step by step guide on how to place your first bet. You can find the guide on this site.

It is important to note that there are loads of different types of bets available for punters. The most popular bets are the accumulator and the single bet. The accumulator bet is when you take three or more selections on one bet ticket.

There is high risk in this bet but there is also potential to win large sums of money. The single bet is when you choose a team to win, lose or draw. This type of bet is the easiest to win but the returns are generally low.

The great feeling you get when your bet wins is only matched by the elation of receiving your cash in hand. There are a number of methods to withdraw your cash with some options taking a few hours while others take up to 24 hours.

These are the steps to follow when you want to withdraw:

We suggest using the Ewallet or Instant EFT method to withdraw your cash as it only takes a few hours.

The bank transfer method could take as long as 48 hours.

One of the most common problems punters experience when making their first withdrawal is the verification of their FICA documents, If these documents are not submitted, the withdrawal will not be authorised.

Choosing the betting site was no easy task as we have a stringent criteria that includes the bookies welcome bonus, betting odds, reputation and of course their customer support.

After our thorough research these are our top 5 betting sites:

There are constantly new betting sites popping up in South Africa due to the demand for online gambling.

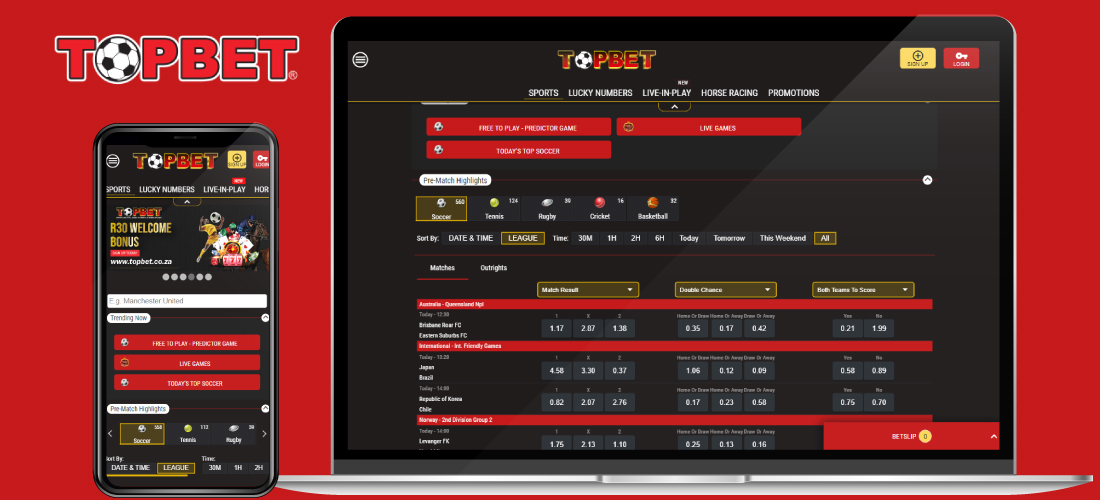

Here are our TOP 3 new betting sites:

Many of the international betting sites in the country have their origins in Europe.

We have picked out the TOP 3 international sites:

Bookies have become very innovative in offering punters all sorts of different bonuses either as a welcome bonus or an incentive if you are already a player at that site. We will take a look at some of these betting sites with free registration bonus in more detail.

As the name suggests this bonus is for new players making their first deposit. This type of bonus can come in the form of a first deposit match offer or it can come as a First Bet being Risk Free.

World Sports Betting has the best welcome offer as they match your first deposit up to an amazing R15000.

This type of bonus is when the bookie offers you a free bet just for signing up. Not many bookies still offer this bonus but Gbets have an excellent double offer for new players.

They give you a R30 free bet for Signing up and they also offer a first deposit match offer of up to R1 000.

This bonus is one of the best as you receive Cashback on your losing bets. Playabets return up to 10% of your net losses for the week on the following Tuesday as part of their Loyalty Program.

One of the biggest reasons for the popularity of sports betting apps is that they help save a lot of money. Some of the best mobile betting apps are easy to install and they can work on any kind of operating system and device. All you have to do is install the app on your phone and you are good to go.

The TOP 3 betting apps in South Africa are as follows:

Some bookies have decided not to have dedicated mobile apps but instead have mobile versions that are brilliant.

Bookies have made topping up your account extra easy with a host of different deposit methods. Here are some of the most popular deposit methods. We have included the time it takes for the deposit to reflect in your account.

| Name of Payment Method | Type of Payment Method | How long does it take | Maximum/Minimum amount |

|---|---|---|---|

| 1 Voucher | Voucher method | Instant | R1/ R10 000 |

| Celbux | Voucher method | Instant | R1/ R10 000 |

| Debit/Credit Card | Bank Transfer | Up to 24 hours | R1/R1 000 000 |

| OZOW | Instant EFT | Instant | R1/R10 000 |

| OTT | Voucher method | Instant | R1/ R10 000 |

| Paygate | Online voucher | Instant | R1/ R10 000 |

| ApplePay | Payment via Apple | Instant | R1/ R10 000 |

We will explain some of the methods in more detail below.

This is one of the best methods to deposit money as it is instant and does not cost you any extra charges. All you need to use this method is a banking app from one of the major banks.

This is the traditional method of depositing funds and it can be frustrating as the funds could take up to 24 hours to reflect in your betting account depending on the bank that you use.

This has become the most popular method to deposit funds as it is instant and the minimum amount is as low as R1. The 1Voucher is available at literally every retail store in the country and the best news is that you don’t need a bank account to purchase a voucher.

The most successful online betting sites are those bookies that understand the local betting market. The common trend that local bookies share with European bookies is the multitude of different betting markets for football.

Apart from this there are not many common factors with local bookies and overseas bookies. Overseas bookies for example are more prone to focus on sports like smaller sports like volleyball and baseball and those are not sports that South Africans generally bet on. Local bookies will have extensive and in depth coverage of rugby while the international sites will not have the same coverage.

There are various types of bets that are available and a single football match can have more than a hundred different bet types for punters. Although there are many types of online bets, some being more complex than others, you can quickly understand all of them with just a little reading up.

Here are five of the most popular types of sports bets explained in full detail, so you know which bet to make when and how to get the most value for your betting money.

This is the simplest of all sports bets and is the most straightforward one to pick up. The win bet is used universally and the way this bet works is that you simply place a wager on the team you think will win the match, and if you get it right, you win the bet.

It can vary from sport to sport, for example, in football, you will also have the draw option to bet on, while in other sports like tennis or playoff basketball games, there are just two options.

Accumulator bets involve placing multiple selections as a part of one single wager. This has become the most popular type of bet due to the potential of major winnings.

However, you have to be careful when making accumulator bets, as they are relatively hard to win, as you have to get every selection right in order to pass your slip. If just one selection fails to win, your entire wager is lost.

But, the upside of this is that, if you win, the returns can be very lucrative.

Handicap betting is one of the most popular types of bets among more experienced bettors. Handicap bets work exactly as they sound. The match favourite is placed under a handicapped situation, while the underdog starts the match with a positive result.

For example, in a football match including Manchester United and Newcastle, online bookies can place a handicap on the teams and give Newcastle a goal advantage at slightly lower betting odds, or place a -1 goal handicap at the expense of Manchester United and increase the odds of betting on them.

Manchester United have to win by at least two goals for you to win the handicap bet. In a way, this is very similar to the first type of bets, only it presents you with different options for betting on the teams you want to place bets on.

Special bets are very fun and entertaining types of wagers that are more often up to luck than anything else.

Serious punters avoid making these types of bets, though if you’re informed, some of these bets can be good opportunities to earn a little extra cash. Special bets are generally specific bets that usually don’t have a direct effect on the outcome of the match in question.

For instance, popular special bets are who will score the first goal, take the first corner, or will any player score a hat-trick.

These bets keep you glued to the match until the final whistle if the result is known.

If you have a favoured team or player to win a specific tournament or competition and you want to bet on this, then outright bets are your best option. These types of bets are basically wagering on the potential winner of the specific competition weeks or months before the competition even starts.

This is also known as ante-post betting. When making outright or ante-post bets, all that matters for you to win the bet is that the team or player you backed at the beginning of the season goes all the way and lifts the trophy at the end.

Sports betting has taken the South African market by storm and has quickly become the favourite pastime of millions of locals. The proof of this is the number of betting companies that have spring up in the last few years.

We have listed the most popular sports that punters bet on and what markets are available for each of these sports. Check our betting guides and fin out which sport might be more profitable for you!

Interested? Check the best sport to bet on article in SA and find out the answer!

Since football is the most popular sport on the planet it is no surprise that there are over a hundred matches to bet on every day. This number rises even higher on the weekends as all the major leagues like the English Premier League, La Liga, Serie A and Bundesliga are of course the local PSL are extensively covered.

All the major tournaments like the Champions League, the World Cup and European Championships are all available to bet on, Football leagues from all corners of the globe are also covered and these include leagues in Africa, Asia, South America and Europe.

Rugby is the second most popular sport in South Africa and the bookies have responded by having betting markets for rugby leagues and tournaments from both the Northern and Southern Hemisphere. The major competitions like the Gallagher Premiership, United Rugby Championships.

Top 14 and Super Rugby are extensively covered. All the major international tournaments like the Six Nations and the Rugby Championships are also extensively covered.

The mushrooming of T20 leagues across the cricket world has taken cricket betting to never before seen heights. All the major T20 leagues like the IPL, BBL, CPL and now the newly launched local SAT20 have extensive betting markets at all the local bookies.

The Test and One day cricket is also covered by all bookies.

There are over 30 different sports to bet on with the bookies listed on this site and while it is difficult to write on each sport, our experts offer advice on the best betting strategies for the most popular sports. You can find these tips on the following link.

One of the biggest and most exciting changes to the online netting market happened a few years ago when live betting was introduced. You can bet on the matches while they are being played which is the most exhilarating feeling for any punter. There are however a few tips that we have for you with regards to live betting:

Watch the entire Game

If you’re even thinking of betting on live matches, you need to prepare to watch the entire game. This lets you look for opportunities that can give you an advantage over the match. It’s best to focus on one match as live betting requires your full attention.

Research the teams pre-game

If there is one word that we can use to accurately describe live betting, it is fast. The live odds are changing every second and if you aren’t prepared, you’re going to find yourself behind the ball and missing out on the bet you want. The best way to get ahead of this is by scouting the bets you’re interested in beforehand and having a plan of attack.

Never chase your pre-game losses

Do not use the live betting as a way to try and chase your losses or make up for a bad bet you made before the game. This is a dangerous vicious downward spiral that you want no part of. It’s possible you could get away with it once or maybe even a couple of times, but it will eventually catch up with you, and you will lose money.

The question of How to win? Is always difficult to answer but our experts will use their extensive betting knowledge to assist you. Firstly remember that gambling should be fun and getting a profit from your bets is only a bonus.

These are some of our tips on how to win your bets:

The security of your account should be top priority and you should never disclose your login details to anyone.

When choosing a password, make it something that you would remember and avoid using your date of birth as a password as it is easy to hack your account.

Some bookies have the 2FA system which is additional security for you.

This system requires two forms of identification to access your account.

One of the most common mistakes punters make is trying to win large amounts of cash without doing any research or homework on the teams. If a team has very high odds, it’s best to stay away from betting on that team.

There are of course times when the rank outsider does win but this rarely happens. Punters often listen to friends or tipsters before making bets and this also generally leads to losses. You must make your own decision to bet, after all it is your money.

Gambling addiction can affect anybody so therefore it is important to remember that you started gambling as a hobby or a way to destress and never as a means for an income. Unlike causal gamblers, people addicted to gambling cannot simply stop when losing or set a loss limit.

They are compelled to keep playing to try to recover their money. In many cases, the person loses more than intended, feels bad about the amount of money lost, and then tries to recoup the losses by gambling even more, which consequently leads to even more money lost.

If you feel your gambling has become uncontrollable and you need help, contact the South African Responsible Gambling Foundation on the number 011 026 7323.

Gambling can be a lot of fun especially if you join the right bookie therefore we have created this platform to assist you in making the best decision according to your gambling needs.

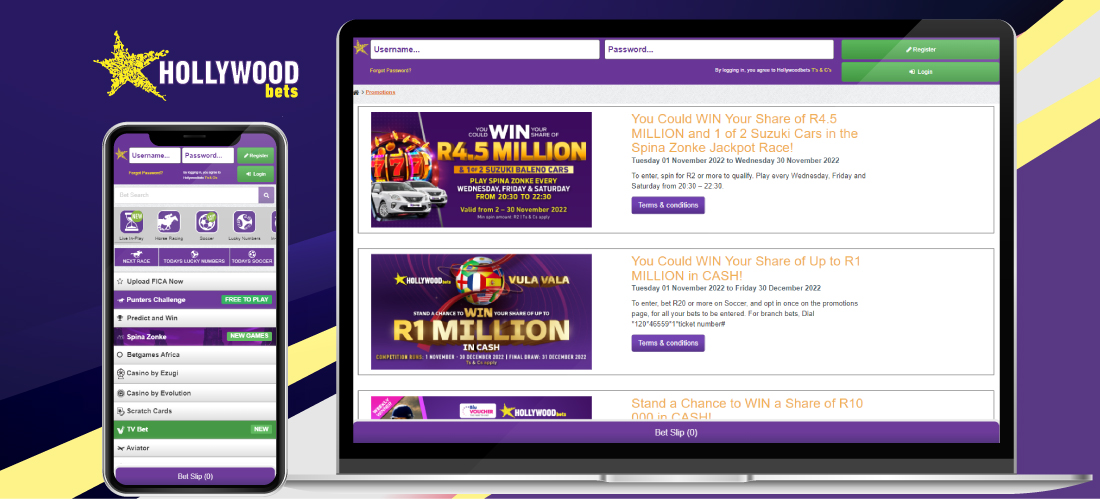

Some bookies specialise in certain types of sports, so if you are a football punter then Hollywoodbets is the site for you. We have only aligned ourselves with bookies who are legal and reputable so you have peace of mind when joining a bookie that we have reviewed.

The numerous numbers of bookies on the local betting market makes it a good time for punters as you can scout around for the best welcome offers before joining a bookie. If you are ready for an awesome adventure, follow one of the links on this page and join a great bookie today.